Trading Rules

This trading application is different so the player needs to understand exactly how it works.

Generic Rules:

- INDICATIVE TARGET PRICES: All target levels seen on screen are only indicative due to internet latency.

- INDICATIVE ‘CASH OUT’ OFFER: We offer a Close Out function almost to the final seconds to expiry. We show an indicative bid to the player who wants to Close Out their trade in order to take their profits or cut their losses. Yet again internet latency shows the Close Out amount to be at that split second in time; the player could get a lower or higher Close Out than was expected.

-

PRICE CHART RENDERING: Price charts take time to render or build in a manner that can be presented on your screen.

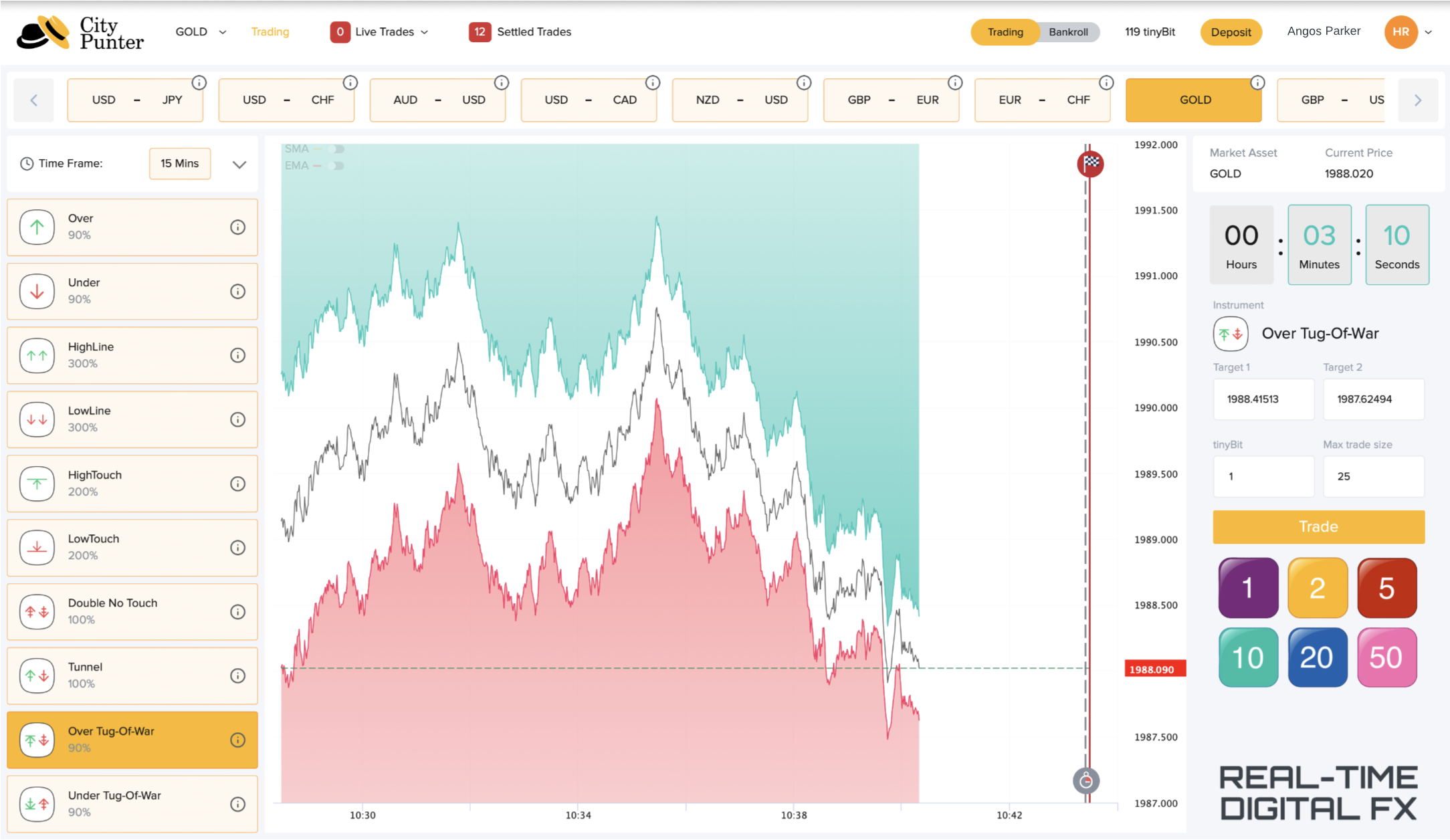

This means there is a slight delay. Below, from the 'Trading' page, top right, you will see a 'Current Price' (1988.020) of Gold.

This is the fastest up-to-date price. The price (11988.090) in the red block sliding up and down the price scale is slightly delayed.

-

TARGET PRICE/ASSET PRICE SPREAD: Over time you will see the target levels move towards the FX price.

This is because we are a sporting lot who want to treat our clients fairly! For example, take a look at the HighLine below.

The payout on this bet type is 4.0 or 300% depending on the format you choose in Settings. If you look at the distance between the FX price (black) and the Target 1 level (blue outlining the turquoise shading) you will see that the gap is greater on the left than just prior to the 'Trading Suspended' vertical dashed line on the right. If this gap between the Target 1 level and FX price was constant throughout the life of the trade then the earlier you place the trade the greater the trader's chance of winning the 4.0, 300% payout. A constant gap between the FX price and the target level means the trader's probability of winning diminishes by the second. A gradual reduction of the gap means the trader has the same probability of winning irrespective of how much time the trade has until it's ended.

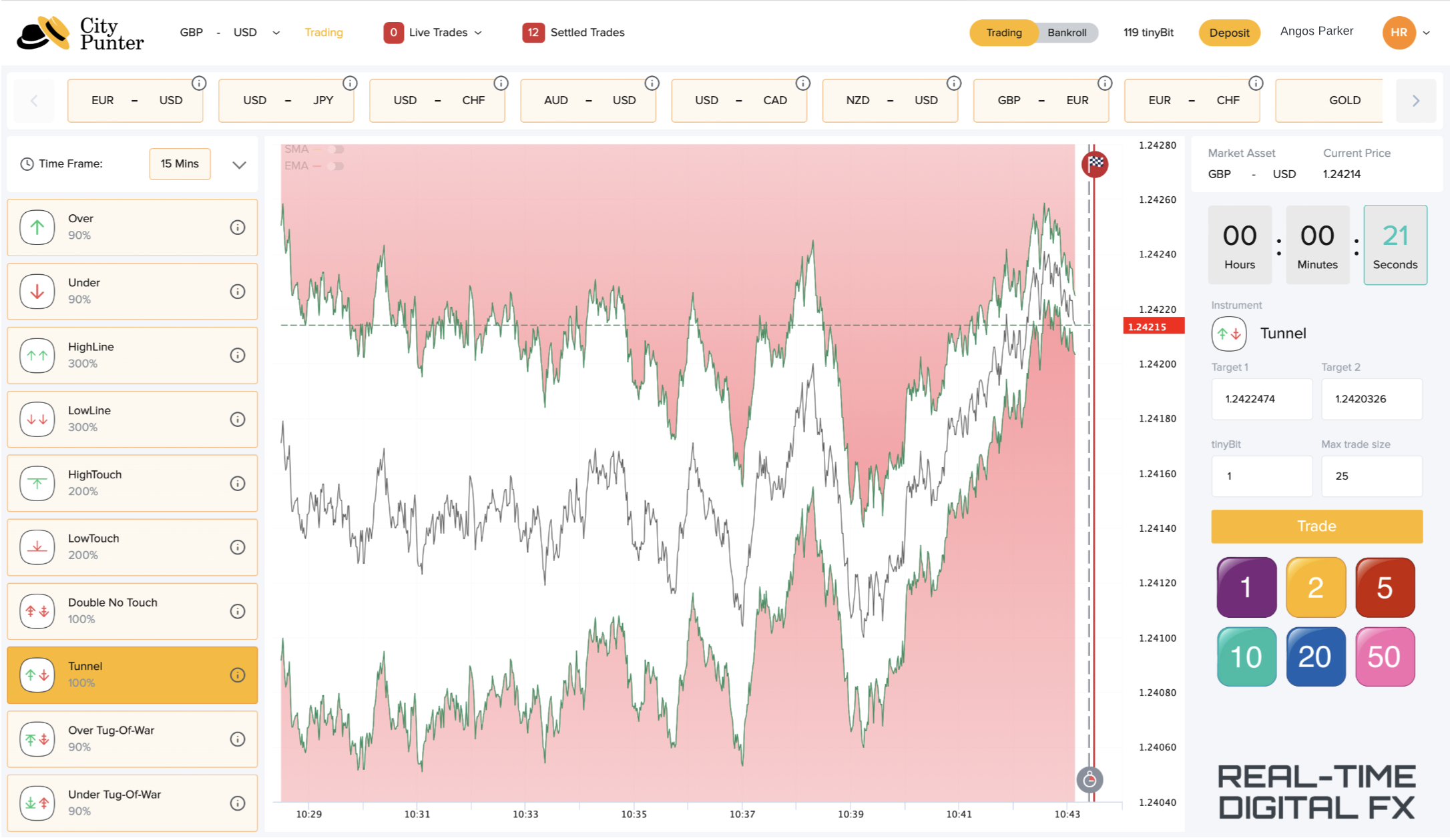

Clearly the jaws of the Tunnel are much wider on the left than on the right of the price chart meaning that you, the trader, have the same probability of winning irrespective of how much time there is before the trade expires. In this instance, if the target level gap was constant then the later the trader leaves it before executing their trade then the greater the chance of the trader winning, which is unfair on (sporting) us.

Clearly the jaws of the Tunnel are much wider on the left than on the right of the price chart meaning that you, the trader, have the same probability of winning irrespective of how much time there is before the trade expires. In this instance, if the target level gap was constant then the later the trader leaves it before executing their trade then the greater the chance of the trader winning, which is unfair on (sporting) us.

-

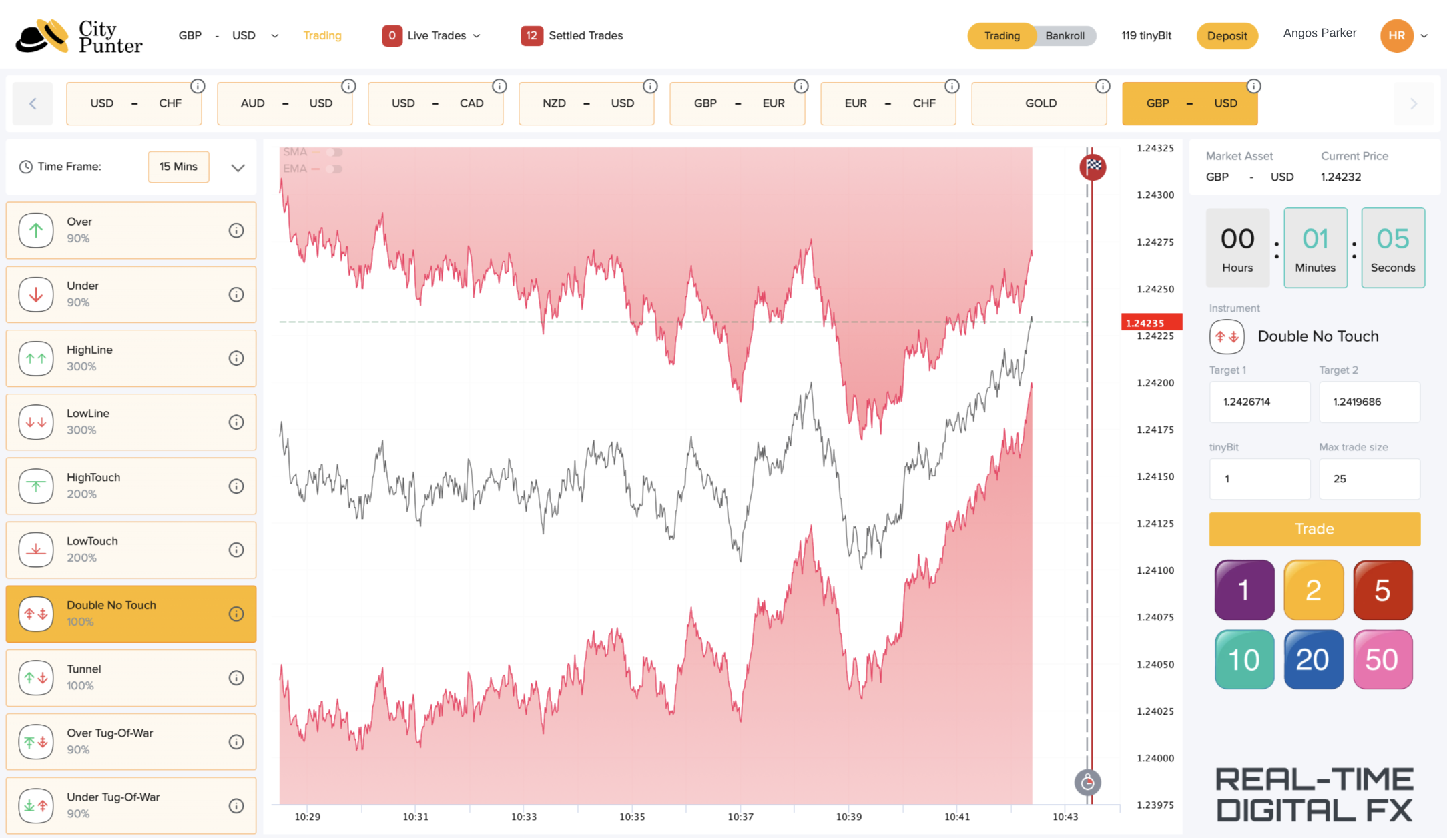

COLOUR FORMATTING: On the Tunnel chart the red is the 'no go' area and is where the trade will lose.

The HighLine chart above shows a blue shading where the trade will win.

This colour format is common to all strategies.

The colour of the lines of the target levels is also relevant. In the Tunnel one can see the boundary lines are coloured green. This means it is OK for the FX price to stray into the red areas and that the position of the FX price at the 'Finish Line' is what counts. Below, the Double No-Touch has red lines (not green) to indicate that the FX price must not even touch one of these lines to avoid the trader being KO'd.